Getting The Tax Debt Relief To Work

Wiki Article

Our Tax Debt Relief Diaries

Table of ContentsWhat Does Tax Debt Relief Mean?Not known Facts About Tax Debt ReliefWhat Does Tax Debt Relief Do?Unknown Facts About Tax Debt ReliefTax Debt Relief Things To Know Before You BuyThe Ultimate Guide To Tax Debt Relief

Take a look at what every taxpayer requires to recognize concerning the Internal revenue service debt forgiveness program. What Is the IRS Debt Forgiveness Program? The Internal revenue service provides numerous relief options for taxpayers who owe unpaid taxes.However, repayment may not be the very best option for you. You might actually have the ability to pay much less general with something like an Offer in Concession or Currently Non Antique standing. It is very important to keep in mind that both of these alternatives require you to divulge financial information to the internal revenue service. The last thing you wish to do is existing info that negates your claim that you're incapable to pay your tax bill.

Call currently to begin the process of cold penalties and also getting financial obligation removed.

5 Simple Techniques For Tax Debt Relief

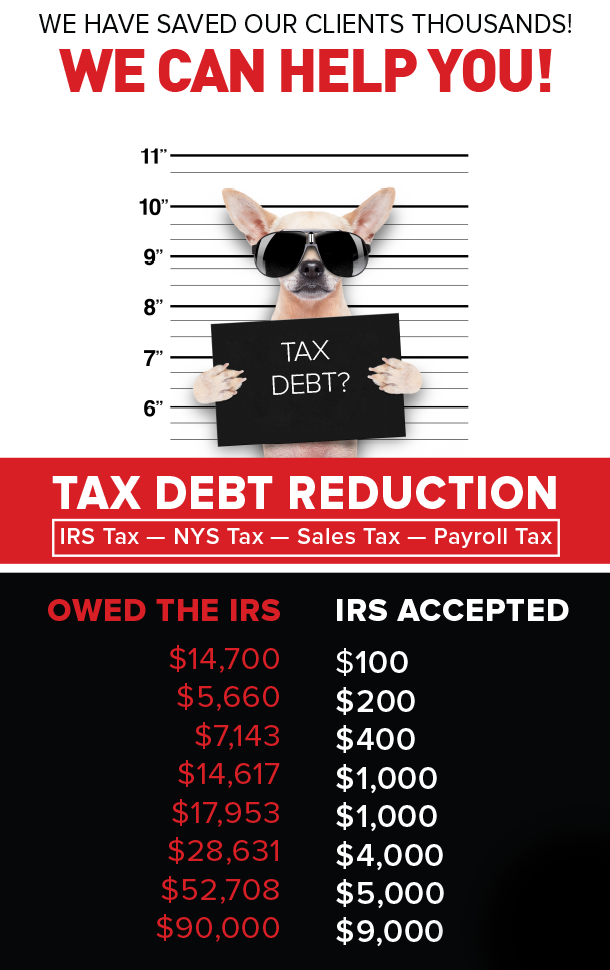

There may be a couple of lawyers and a handful of people in the company who did function for the Internal revenue service at some factor, the bulk of workers possibly have not. What Tax Settlement Firms Offer Most tax obligation negotiation companies guarantee to send their professionals to the IRS to negotiate on behalf of the customer, where they can probably persuade the firm to approve a much smaller sized amountoften pennies on the dollar.

This is a special arrangement that some taxpayers can make with the IRS to settle their tax debts for a lesser amount than what is owed.

Not known Facts About Tax Debt Relief

The variety of offer-in-compromise applications that are actually authorized is normally extremely low. To have such a decrease authorized, taxpayers have to confirm that the total amount owed is inaccurate, the likelihood of having the ability to repay the total is extremely low, or paying back the full quantity will certainly result in incredible monetary challenge.This is usually the quantity of money the business states it will conserve the customer in tax obligation repayments. Clients have actually whined to the Better Company Bureau (BBB) and the Federal Trade Payment (FTC) that a few of these firms have not produced any of the promised outcomes and also, actually, the company was a rip-off.

Any credible tax obligation relief firm will initially get crucial financial information from its consumers before providing a practical evaluation of what they can do for a practical set charge. Prospective customers would certainly be a good idea to find a regional firm that has actually been in service for a number of years try this site and has a visibility in the neighborhood.

What Does Tax Debt Relief Mean?

The Internal revenue service previously provided cautions to the public about deceitful firms, citing numerous of the issues provided below.On the other hand, excellent firms bill reasonable, clear costs as well as have shown track records. Some business charge a level portion of the quantity owed to the Internal revenue service, such as 10%.

While lots of taxpayers receive reimbursements at tax time, coming up brief is not unusual - Tax Debt Relief. (Word to the wise: File your taxes!

Some Ideas on Tax Debt Relief You Should Know

Which one is ideal for the his comment is here tax-debtor depend upon his/her general financial condition. That might need tax-debt relief? Taxpayers that have dropped behind and lack the resources to pay their debt using individual car loan, residence equity car loan, credit rating card, financial investments, and so on. Taxpayers behind who have actually pertained to the attention of exclusive debt collectors employed by the IRS.Those that have stopped working to submit income tax return for any kind of number of years, however that have (so far) handled to run below the radar of the IRS.Taxpayers whose financial debt is so "seriously delinquent" ($50,000 or more) the IRS has actually advised the State Division to deny, withdraw or take their passports.

Any of the programs can be self-initiated by the taxpayer. While the majority of tax negotiation services proclaim rosters of previous IRS representatives and various other tax professionals ready to use their expertise to lower what you owe, the fact is something different.

Some Known Incorrect Statements About Tax Debt Relief

The IRS evaluates a host of variables, among them ability to pay, revenue, expenses, as well as possession equity. The agency typically authorizes a deal in compromise only when the amount supplied stands for one of the most it can expect to accumulate in an affordable time period. Applications should be gone along find with by a settlement of 20% of the complete offer amount, plus a nonrefundable $186 fee.Report this wiki page